Allegro Microsystems Inc

$ 26.53

-1.27%

29 Dec - close price

- Market Cap 4,974,149,000 USD

- Current Price $ 26.53

- High / Low $ 26.85 / 26.32

- Stock P/E N/A

- Book Value 5.10

- EPS -0.16

- Next Earning Report 2026-01-29

- Dividend Per Share N/A

- Dividend Yield 0 %

- Next Dividend Date -

- ROA N/A %

- ROE -0.03 %

- 52 Week High 38.45

- 52 Week Low 16.38

About

Allegro MicroSystems, Inc. is a prominent provider of advanced integrated circuits (ICs), focusing on sensor and analog power applications with a strong emphasis on motion control and energy-efficient systems. Headquartered in Manchester, New Hampshire, Allegro drives innovation across the automotive, industrial, and consumer electronics sectors, delivering high-performance solutions that meet the evolving needs of its markets. The company's dedication to sustainable technology positions it as a vital player in the shift towards more efficient electronic systems, catering to the increasing demand for energy-efficient solutions in a rapidly advancing technological landscape.

Analyst Target Price

$38.42

Quarterly Earnings

| Sep 2025 | Jun 2025 | Mar 2025 | Dec 2024 | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | Dec 2022 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Reported Date | 2025-10-30 | 2025-07-31 | 2025-05-08 | 2025-01-30 | 2024-10-31 | 2024-08-01 | 2024-05-09 | 2024-02-01 | 2023-11-02 | 2023-08-01 | 2023-05-10 | 2023-01-31 |

| Reported EPS | 0.13 | 0.09 | 0.06 | 0.07 | 0.08 | 0.03 | 0.25 | 0.32 | 0.4 | 0.39 | 0.37 | 0.35 |

| Estimated EPS | 0.12 | 0.08 | 0.05 | 0.06 | 0.06 | 0.02 | 0.21 | 0.29 | 0.37 | 0.37 | 0.36 | 0.32 |

| Surprise | 0.01 | 0.01 | 0.01 | 0.01 | 0.02 | 0.01 | 0.04 | 0.03 | 0.03 | 0.02 | 0.01 | 0.03 |

| Surprise Percentage | 8.3333% | 12.5% | 20% | 16.6667% | 33.3333% | 50% | 19.0476% | 10.3448% | 8.1081% | 5.4054% | 2.7778% | 9.375% |

Next Quarterly Earnings

| Dec 2025 | |

|---|---|

| Reported Date | 2026-01-29 |

| Fiscal Date Ending | 2025-12-31 |

| Estimated EPS | 0.08 |

| Currency | USD |

Next Dividend Records

| Dividend per share (year): | - |

| Dividend Yield | - |

| Next Dividend Date | - |

| Ex-Dividend Date | - |

Recent News: ALGM

2025-12-29 21:58:00

Allegro Microsystems Inc. (NASDAQ: ALGM) is exhibiting divergent sentiment across all horizons, suggesting choppy conditions with a mid-channel oscillation pattern. The AI models have generated three distinct trading strategies (Position Trading, Momentum Breakout, and Risk Hedging) tailored to different risk profiles. A notable 73.9:1 risk-reward setup targets a 20.6% gain versus a 0.3% risk.

2025-12-23 05:10:13

|Allegro MicroSystems (ALGM) saw a 4% climb after Micron Technology's upbeat revenue forecast boosted the semiconductor sector, especially AI-exposed chipmakers. Despite a recent rebound and significant revenue growth, ALGM is still trading below consensus price targets, leading to questions about whether it is an underappreciated AI enabler or if its growth is already priced in. The company's valuation narrative suggests it is undervalued, with a fair value of $38.58 against a current price of $26.70.

2025-12-23 03:08:47

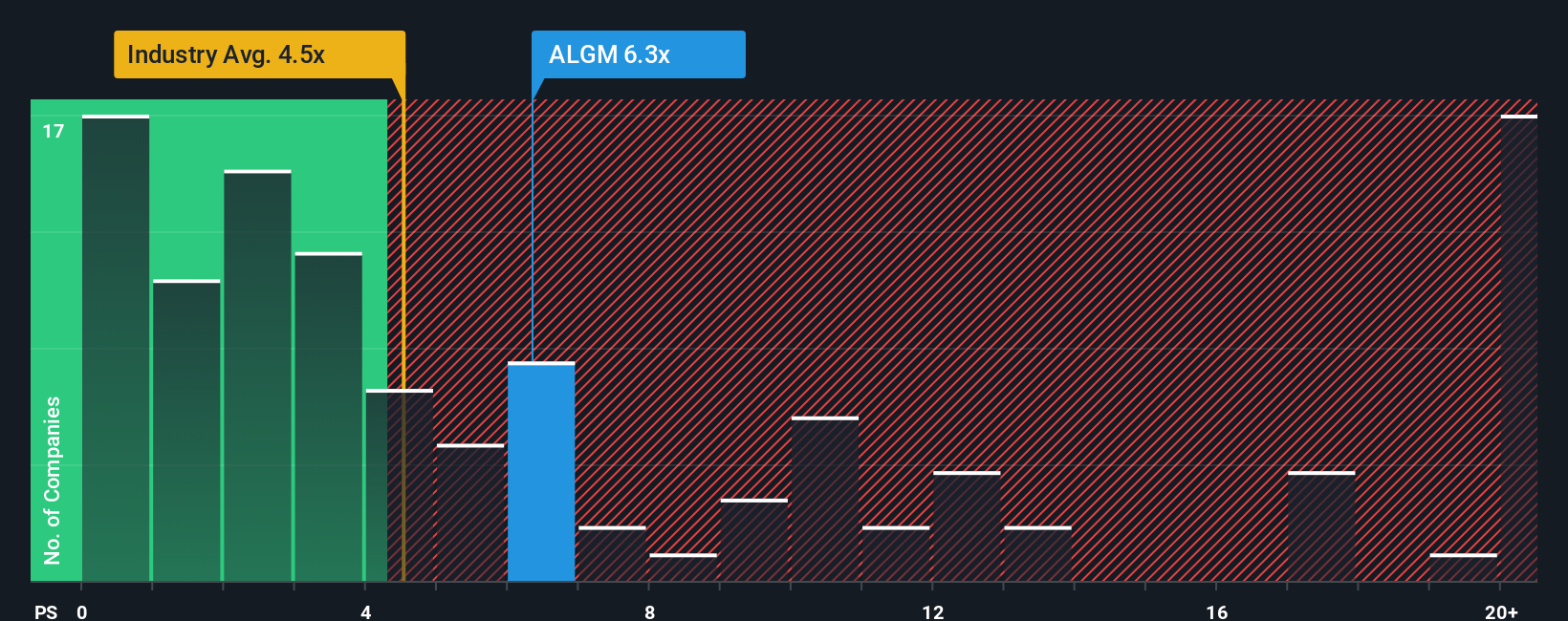

Allegro MicroSystems (ALGM) saw a 4% climb after Micron Technology's upbeat revenue forecast boosted semiconductor sentiment. While trading below consensus targets, Allegro's valuation presents a mixed picture: a narrative fair value suggests it's undervalued, but its price-to-sales ratio is higher than the US Semiconductor average. Investors are weighing whether it's an underappreciated AI enabler or if its growth is already priced in.

2025-12-21 05:09:10

Allegro MicroSystems (ALGM) saw a 4% climb after Micron Technology's optimistic revenue forecast boosted the semiconductor sector, especially for AI-exposed chipmakers. Despite a recent share price rebound, Allegro MicroSystems is trading below consensus price targets, leading to questions about whether it's an undervalued AI enabler or if its growth is already priced in. The article explores the company's valuation, noting it's considered 30.8% undervalued based on a narrative fair value of $38.58, but its price-to-sales ratio of 6.3 times is higher than the US Semiconductor average.

2025-12-19 05:09:10

This article suggests that options traders are anticipating a significant price movement in Allegro MicroSystems (ALGM) stock, as indicated by the high implied volatility of its Jan 16, 2026 $17.50 Call options. Despite this, analysts currently rate Allegro MicroSystems as a Zacks Rank #3 (Hold) in the Electronics - Semiconductors industry, with recent downward revisions to earnings estimates. The discrepancy between options market expectations and analyst sentiment could signal a potential trading opportunity or a strategy for seasoned options traders to sell premium.

2025-12-18 20:09:52

This article analyzes Allegro Microsystems Inc. (NASDAQ: ALGM), highlighting weak near-term sentiment despite potential long-term strength. It details an exceptional 76.4:1 risk-reward setup targeting a 21.1% gain with minimal risk, and provides three AI-generated trading strategies—Position, Momentum Breakout, and Risk Hedging—tailored for different risk profiles. The analysis also includes multi-timeframe signal analysis, showing varying signal strengths across near, mid, and long-term horizons, and offers real-time signals with API integration and custom risk models.